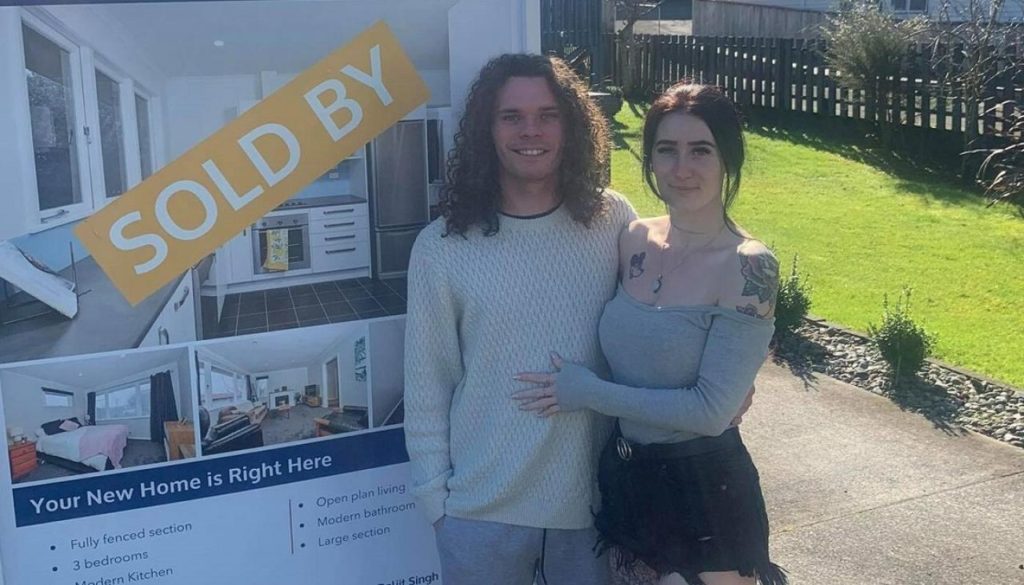

Observant Kiwis will have noticed a recent deluge of articles featuring young couples who have just bought a house. These are presented as heart-warming tales of plucky young people overcoming the odds, but they’re actually very insidious works of propaganda. This essay explains.

The New Zealand housing crisis is now so bad that, if it was half as bad, houses in Auckland would still be considered “severely unaffordable”. The Demographia international housing affordability survey (link goes to .pdf) considers a country’s housing to be unaffordable if it is three times the median household income, and severely unaffordable if it is more than 5.1 times the median household income.

According to the housing affordability calculator at interest.co.nz, the average New Zealand house price was 8.43 times the median household income in July 2021. The average Auckland metro house price was 11.32 times the median household income. These figures mean that even second-tier cities like Nelson and Dunedin are severely unaffordable. The thought of owning one’s own home, once considered a standard part of life, is now just a distant dream to most Kiwi workers.

This housing crisis is having severe consequences. It has meant that great numbers of young Kiwis have seen their dreams evaporate. Their hopes – if not expectations – of raising a family that they could be happy with are gone. Raising a happy family is a function of many things, but one of the most important ones is security of housing. Security of housing is only for the rich when the median house price is ten times the median household income.

Without a hope of raising a happy family, many people give up. The prospect of genetic immortality through one’s offspring appears to be the fundamental drive keeping great numbers of people going. Without it, a deep sense of anomie sets in, usually followed by nihilism. This latter condition can lead to all manner of atrocities, as the 20th Century demonstrated beyond doubt.

The obvious risk facing Western society in coming years is, by now, apparent to most. The widespread anomie and nihilism brought about by the housing crisis could lead, in short order, to equally widespread chaos and destruction. In other times and places, an entire generation getting locked out of housing would lead to civil unrest. The ruling class knows history, so they know that mass violence is potentially not far away.

Kiwis are a gutless slave race, as shown by our current wretched state, but even we will protest if we’re all made homeless. It’s to pre-empt these potentially riotous emotions that the mainstream media runs so many “Young couple buys a house!” stories. Their intention is to normalise the idea that a typical young couple can easily buy a home in today’s market.

If it was widely believed that a young couple could easily buy a home in New Zealand today, much of the discontent from the way the country is being run would be neutralised. Any young person complaining about how much easier the Boomers had it could simply be referred to the young couple in the NewsHub article linked in the first paragraph.

“If they can do it, why can’t you?” the Boomers will cry. You just need to get off your arse etc.

At times like these, it has to be borne in mind that the mainstream media is owned by international banking and finance interests, and so the media only runs stories that serve those interests. Banks want the highest possible house prices, because that means the maximum possible mortgage profits. To that end, they want to normalise mass immigration and million-dollar mortgages, and to abnormalise multi-generational housing.

Ultimately, the reason for all the “Young couple buys house” propaganda is to stop young people from getting angry at the intergenerational rape being committed against them by the Boomers. Pre-empting this anger will allow those Boomers to ride the gravy train for as long as possible.

The mainstream media will do everything it can to create the impression that homeownership is still normal for young people, and to deny the grim reality that even families with two working adults have trouble owning the roof over their heads. If they would admit the latter, they would run the risk of powerful revolutionary sentiments taking hold.

*

If you enjoyed reading this essay/article, you can get a compilation of the Best VJMP Essays and Articles of 2020 from Amazon for Kindle or Amazon for CreateSpace (for international readers), or TradeMe (for Kiwis). A compilation of the Best VJMP Essays and Articles of 2019, the Best VJMP Essays and Articles of 2018 and the Best VJMP Essays and Articles of 2017 are also available.

*

If you would like to support our work in other ways, please consider subscribing to our SubscribeStar fund. Even better, buy any one of our books!